Internet banking: the future of Indian banking is a method of performing online transaction. For performing online Transaction, a customer has to register on the respective bank website and set up a password for security purpose. The passwords should be strong must not be disclose to anyone. For every online Transaction customer must know the IFSC Code to identify the Bank branch involving in the transaction process. Here is some more explanation about IFSC Code :

The use of IFSC Code in online banking

In online banking we can do many financial operations:

Bill payments

Fund transfer between other accounts

Fees payments

Online shopping

Loan applications

Installments and many more activities.

To performing any of above transaction we need IFSC Code of bank branches involve in transaction process. Here take an instance, suppose customer need to transfer some fund to another person of any another bank and of different place and different bank branch.

Here, customer need the IFSC Code of the bank branch in which he has an bank account and also the IFSC Code of the bank branch in which the another person has account.

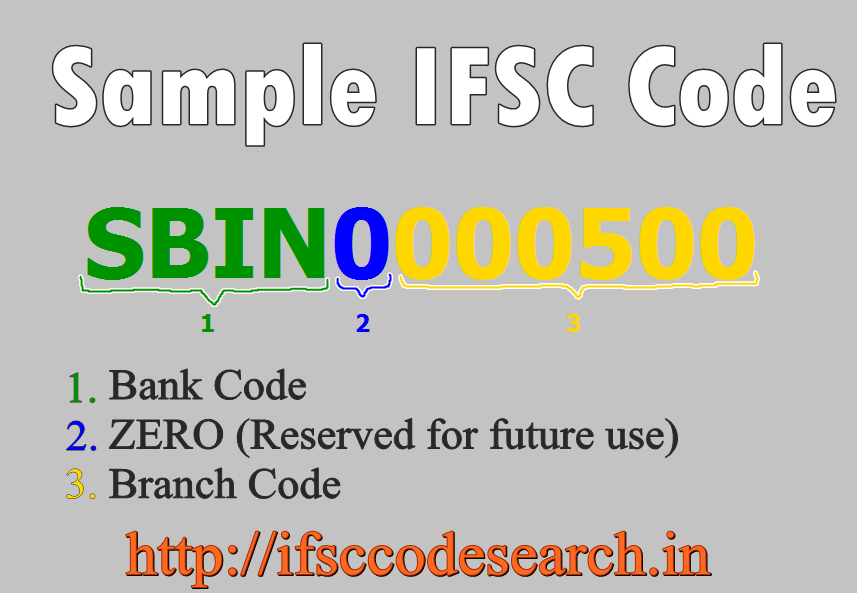

IFSC Code (Indian Financial System Code): This code is given out by RBI to distinguish each bank branches in India. It is an 11 characters code, the first 4 characters represent the name of bank and the last 7 digits represent the Bank branch Code.

The use of IFSC Code in online banking

In online banking we can do many financial operations:

Bill payments

Fund transfer between other accounts

Fees payments

Online shopping

Loan applications

Installments and many more activities.

To performing any of above transaction we need IFSC Code of bank branches involve in transaction process. Here take an instance, suppose customer need to transfer some fund to another person of any another bank and of different place and different bank branch.

Here, customer need the IFSC Code of the bank branch in which he has an bank account and also the IFSC Code of the bank branch in which the another person has account.

You can find IFSC Codes for various bank branches in India on ifsccodesearch.inUsually customer can transfer funds through NEFT and RTGS. And Both NEFT and RTGS transfer process require IFSC Code of both source and destination bank branches and also both these accounts must be NEFT or RTGS enabled.

Thank you

No comments:

Post a Comment